does nh tax food

Property taxes that vary by town. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

The State of New Hampshire does not issue Meals and Rooms Rentals Tax exempt certificates.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. A 9 tax is also assessed on motor vehicle rentals. New Hampshire is one of the few states with no statewide sales tax. Meals and Rooms Tax.

The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. Since the state controls all liquor sales it levies a flat 30-cent tax per gallon of alcoholic beverages sold at. Does Nh Tax Food does food Prepared food is subject to special sales tax rates under new hampshire law.

Interest and Dividends Tax. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable. Concord NH 03305 603 271-2382 Who pays it.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Click here for a list of other states with no sales tax. Real Estate Transfer Tax.

Find The Federal And State Income Tax Forms You Need For 2019 Official Irs Tax Forms With Instructions Are Printable And Ca Income Tax Irs Tax Forms Tax Forms. Its 9 on sales of prepared and restaurant meals and 10 on alcoholic beverages served in restaurants. The tax should be applied to the sale amount after the discount or coupon reduction has been taken.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services. New Hampshire Consumer Taxes at a Glance New Hampshire does not have a sales tax and has some of the lowest gasoline taxes in the country. New Hampshires beer excise tax is ranked 21 out of the 50 states.

New Hampshire Sales Tax Rate 2022 Homestead Food Operations Food Protection Division Of Public Health Services Nh Department Of Health And Human Services Cut To Meals And Rooms Tax Takes Effect Nh Business Review In Which States Are Groceries Tax Exempt Sales Tax Grocery Items Tax. Whilst tourists save money on shopping because of the 0 sales tax on goods purchased in stores they will pay more for the services above. New Hampshire does not levy an estate tax although residents are liable for the federal estate.

New Hampshire does tax income from interest and dividends however. Quarterly Fund Balance Reductions and. Meals and Rentals Tax.

If you have any questions about tax exempt sales please call the Department for clarification at 603 230-5920. Milk Eggs Fish eg bass flounder cod Crustacean shellfish eg crab lobster shrimp Tree nuts eg almonds walnuts pecans coconut Peanuts Wheat Soybeans 5. How should I handle coupon and discount sales.

New hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. There are however several specific taxes levied on particular services or products. Does nh tax food.

Even this tax is set to be phased out soon. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. This includes hotel and room taxes fees other surcharges as well as New Hampshires 9 Meals and Rooms tax.

The State of New Hampshire does not issue Meals and Rooms Rentals Tax exempt certificates. Chapter 144 Laws of 2009 increased the rate from 8 to the current. A 7 tax on phone services also exists in NH.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. Meals and Rooms Tax Where The Money Comers From TransparentNH. New Hampshire currently taxes investment income and interest.

This is a flat 5 individual rate. A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency. The State of New Hampshire does not have an income tax.

New Hampshire is one of the few states with no statewide sales tax. For all intents and purposes however the Granite State does not have a state income tax in that it takes no percentage of an individuals salary. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications.

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

New Hampshire Sales Tax Handbook 2022

Turbotax Halts E Filing Of State Tax Returns Turbotax Online Taxes Income Tax Preparation

Tax Free Period Tampon Tax Tax Free Tax Day

Cost Of Hotel Taxes Infographic Away Com

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Pin On Favorite Fast Food Places Fast Food

10 Most Tax Friendly States For Retirees Retirement Best Places To Live Us Map

New Hampshire Meals And Rooms Tax Rate Cut Begins

Nh S Most Flavorful Vegan Finds Vegan Menu Vegan Flavors

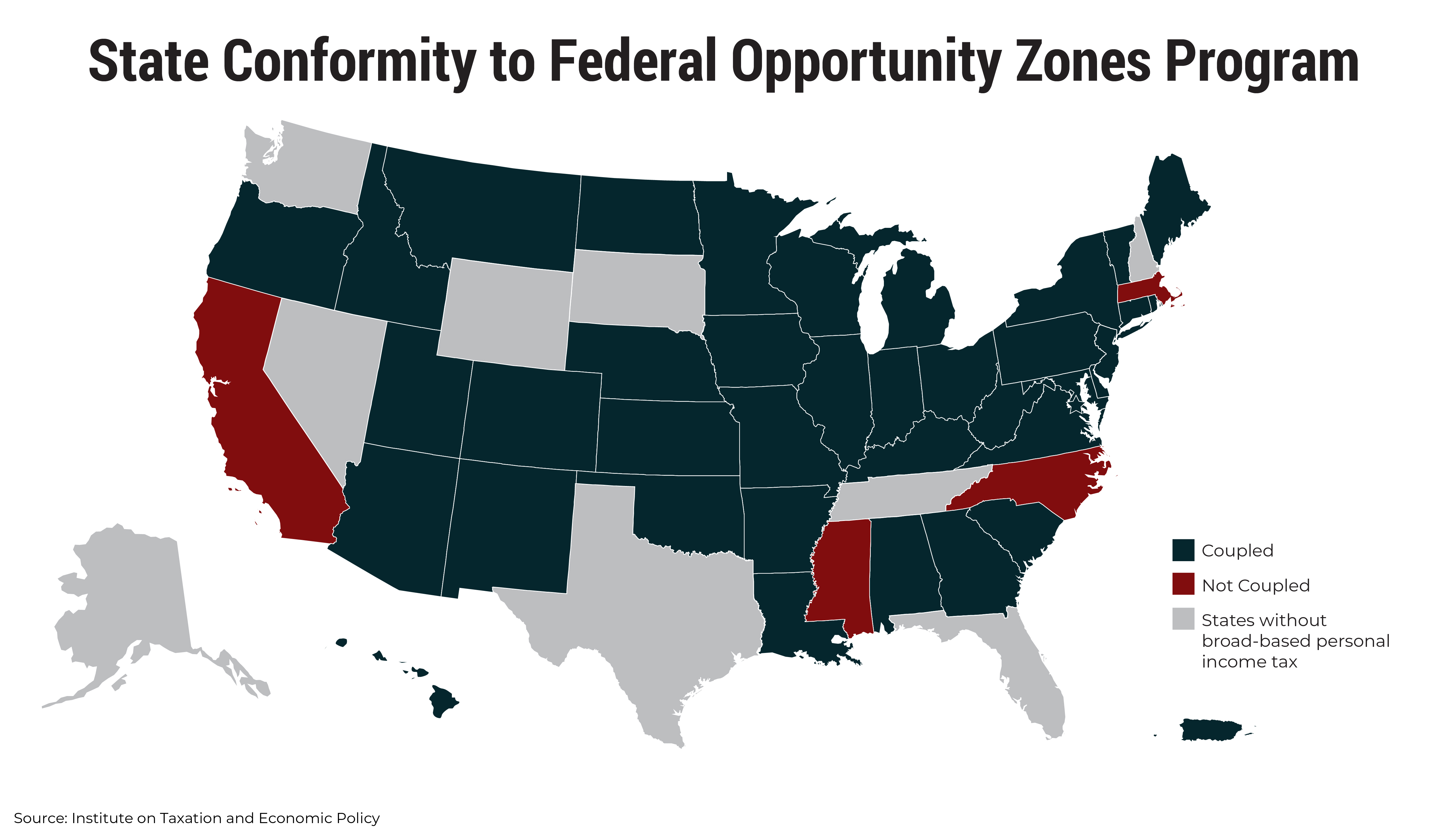

States Should Decouple From Costly Federal Opportunity Zones And Reject Look Alike Programs Itep

Sales Tax On Grocery Items Taxjar

State Exit Tax Do You Have To Pay The Tax Moving To Another State Small Business Tax Tax

Pin By Bellshomestead On Planning Our Homestead Prepared Foods Food Protection Lemon Balm

What To Do In Portsmouth Nh Portsmouth Travel Guide Portsmouth Nh Portsmouth Travel Guide

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax